Case study: how two firms are dealing with the journey to automation

Joseph Pinto, Global Chief Operating Officer at AXA Investment Managers and Mr. Vikramaaditya, Chief Transformation & Administration Officer at HSBC Global Asset Management share where their firms have got to on the journey to full automation

Sara Benwell POSTED ON 4/20/2020 5:53:25 PM

Sara Benwell: Where are you on the automation journey?

Joseph Pinto: AXA IM started the journey about three years ago by building a transversal team in charge of embracing technology and convincing the business that automation can add value.

The journey started with the IT, operations and finance departments and use cases were built.

AXA IM then tried to move to the portfolio management area. It was quite challenging initially as their immediate reaction was that they did not need help.

"AXA IM started the journey about three years ago by building a transversal team in charge of embracing technology"

As pressure on costs have increased along these years, the need to use RPA has also been expressed by them afterwards.

AXA IM started the process by selecting a couple of potential providers and ended up choosing the one that suited its needs the most.

"AXA IM has already successfully automated more than 50 processes and has reached a pace of onboarding one newly automated process per week."

In order to execute fast and learn, consultants who had done it before were initially used, then as the program became bigger and bigger competencies were internalised.

As of today, AXA IM has already successfully automated more than 50 processes and has reached a pace of onboarding one newly automated process per week.

Six robots are in use and the percentage of use on these robots is only around 15 per cent. So, there is still a long way to go increase usage rate.

Mr. Vikramaaditya: For context, HSBC Asset Management manages about 500 billion dollars of assets globally across 26 countries.

We operate in all asset classes and have investment management capabilities on the ground in 16 locations globally.

We are therefore quite diverse in terms of asset classes and client segments as well.

"We started this journey several years ago and our data platforms are quite well established now"

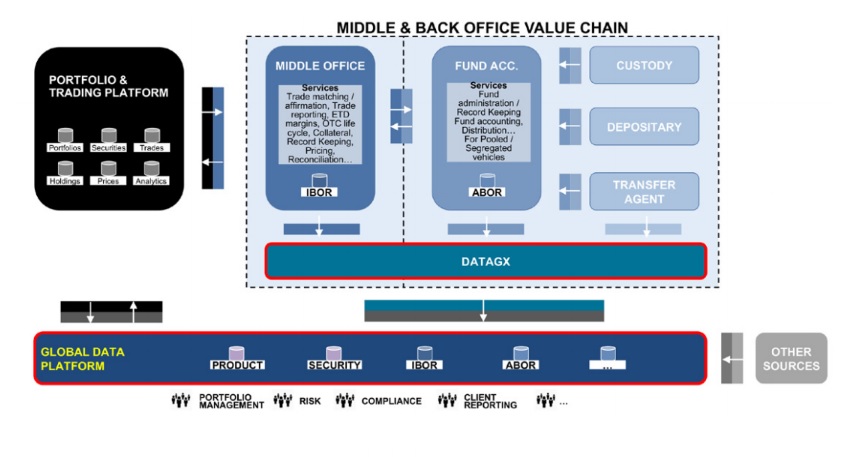

Data is at the heart of any automation initiative that we are driving. In terms of the data strategy that we have adopted, given HSBC has been operating for a long time, we do have legacy platforms, processes and businesses in a variety of sites.

So, one of the key objectives of our data strategy was to be able to bring all of this together.

We started this journey several years ago and our data platforms are quite well established now.

Essentially, the focus was to have the ability to integrate data from across all of our sites and provide good quality, consistent and timely data to all of our consuming platforms which would be our risk platforms, front office tools or even reporting platforms etc.

We have been able to successfully create this layer to be able to provide that information and that data on a consistent basis.

"The focus was to integrate data from across all of our sites and provide good quality, consistent and timely data to all of our consuming platforms "

A key aspect of this was the creation of golden sources which are sources that consuming platforms could rely on to be able to access the right quality of data for their processes.

We aren’t finished on this journey as when you talk about automation and data the goal posts are always moving.

We may progress but there will always be more to do. Clearly as we look ahead, we still have more that we are looking to do and more that we are looking to invest in terms of enhancing and upgrading our data platforms.

Please Sign In or Register to leave a Comment.

SUBSCRIBE

Get the recent popular stories straight into your inbox