Gavin Lau, Managing Director, Head of Private Credit Fund Management, Macquarie Asset Management and Andy Murray, Managing Director, Product Management, Oaktree Capital Management.

Gavin Lau, Managing Director, Head of Private Credit Fund Management, Macquarie Asset Management and Andy Murray, Managing Director, Product Management, Oaktree Capital Management.

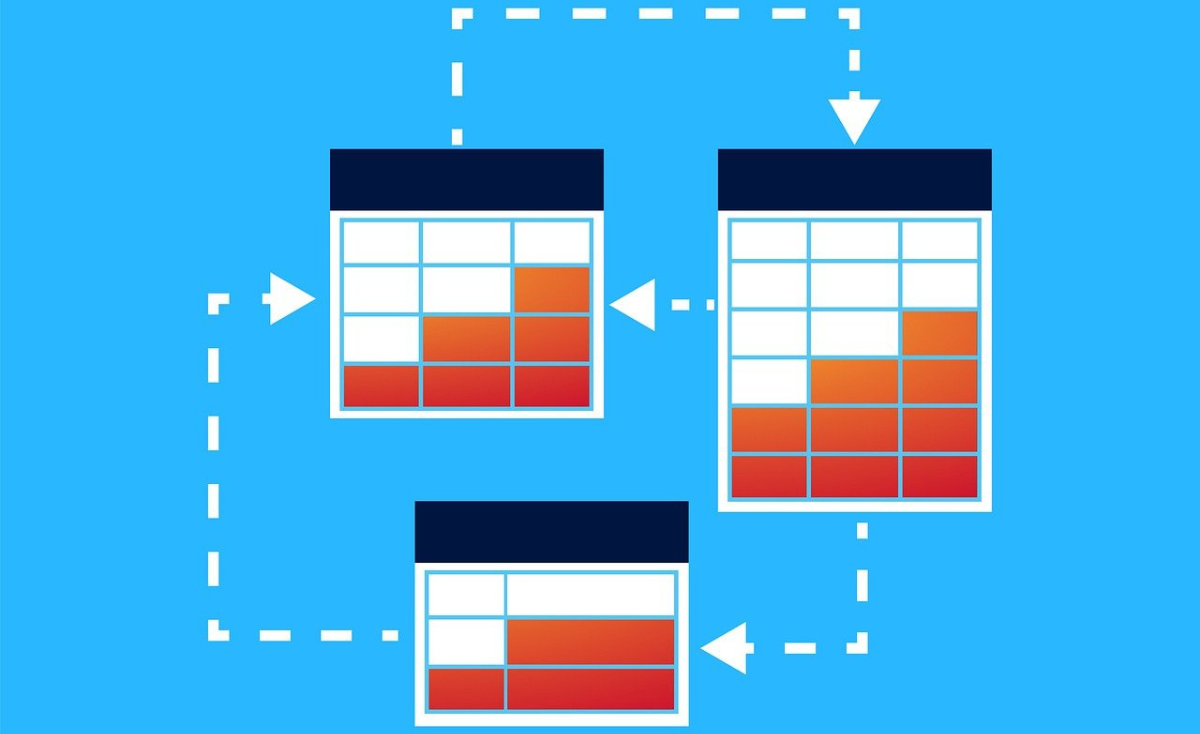

How do you optimise operations to achieve a robust private credit strategy?

That was the question in a recent Clear Path Analysis webinar where several industry experts gave their views on the rapid increase in interest in private assets. As part of this, the discussion also included residential home loans and private credit – more specifically as an asset class – and what needs to be looked at to achieve success.

The discussion explored how managers can ensure that their teams are optimised to manage asset inflow and growth objectives.

The conversation now forms the basis of a new report, “Addressing operational challenges around launching a private credit strategy”, sponsored by Arcesium.

In it, the figures – from Arcesium, Oaktree Capital Management, Bayview Asset Management, Russell Investments and Macquarie Asset Management – share their views and practical advice on how best to achieve good results.

“When considering going into the market, it is about starting with an inward assessment of the manager’s resources, so, if I put myself in your shoes, am I looking at an in-house solution where I build everything internally or would I like to start with an outsource model,” said Gavin Lau, Managing Director, Head of Private Credit Fund Management, Macquarie Asset Management, who kicked off the conversation with a detailed to-do list of where to look for details.

The second point he gave was around core competency, and what you can lean on internally from the specialists you have in-house versus everything external, is an FX manager going to outsource your onboarding, etc.? “The objective is to build end-to-end processes from the outset that cover your operations and governance controls,” he said. “These may seem fragile at first in that you may find hiccups and you will spend days fixing this but over time it will become more robust at which point you can start scaling. This scaling capability will be traded off with investor demands as you do not always want to jump when an investor says so, but this comes with experience and when you get through your first fund and then different vintages.”

Another point Lau made was the alignment of a business looking at this area with its other existing operations. “What I tend to find is that having that intimate feedback loop with your investor relations team is important. Also, your management team and what their aspirations are for the product they want to launch.”

Lau said it was about the kinds of structures available to you and whether it is scalable around the volume of transactions over a 10–15-year fund life. “You do not want something that you can offer in the first twelve months, but which is a manual process over the next 12-15 years as that is not where you want to be.”

Other panellists had different experiences and saw other ways that operations teams could be best utilised in these sorts of processes.

“The way that we look at the approach is that investor requirements drive the vehicle structure, which drives what the supporting operating model is,” said Andy Murray, Managing Director, Product Management, Oaktree Capital Management. “When we are looking at various client demands, they result in different needs from an operational perspective so investors in say private credit with US exposure, we will need to think about solutions for tax leakage which can result in having below fund structures such as levered blockers, season and sell, and treaty structures, etc.

For each of these, you are going to end up with a different operating approach that needs to be thought through.”

He said the downstream impact of this on the investment and non-investment teams is considerable. “Just on the basic side, if you are looking at credit and you have got a very different model for looking at valuation loan servicing, accounting, etc. You are also dealing with these multiple below the fund entities. There is a volume play that you also have to factor into it.

On the investment side, Murray said, if you are looking into these multiple structures then you may be in a situation where you are dealing with regulated vehicles.

“So, the investment team may need to think more about allocations or restrictions for instance, [Luxembourg] funds being different to Cayman funds,” he said and explained that there could be situations where you are investing side by side with private funds for high net worth versus a co-mingled fund for German insurance investors – what would this mean and how would you need to work in it?

“With every twist when we turn into a new area, we are constantly needing to be nimble and stay on top of regulatory regimes,” he said.

You can read more of Lau and Murray’s thoughts, and the report in full, here.

Please Sign In or Register to leave a Comment.

SUBSCRIBE

Get the recent popular stories straight into your inbox