What are the challenges in investment performance reporting?

Ester McEwan, Chief Financial Officer of Funds, Bayview Asset Management, and Keith Brakebill, Senior Portfolio Manager, Investment Division, Russell Investment, share their views on workflow structures for private credit strategies.

Fund Operator Editor POSTED ON 1/7/2025 9:00:00 AM

@Pixabay.

@Pixabay.

What are the challenges in investment performance reporting?

That was the question in a recent Clear Path Analysis webinar where several industry experts gave their views on the rapid increase in interest in private assets. As part of this, the discussion also included residential home loans and private credit – more specifically as an asset class – and what needs to be looked at operationally to achieve success.

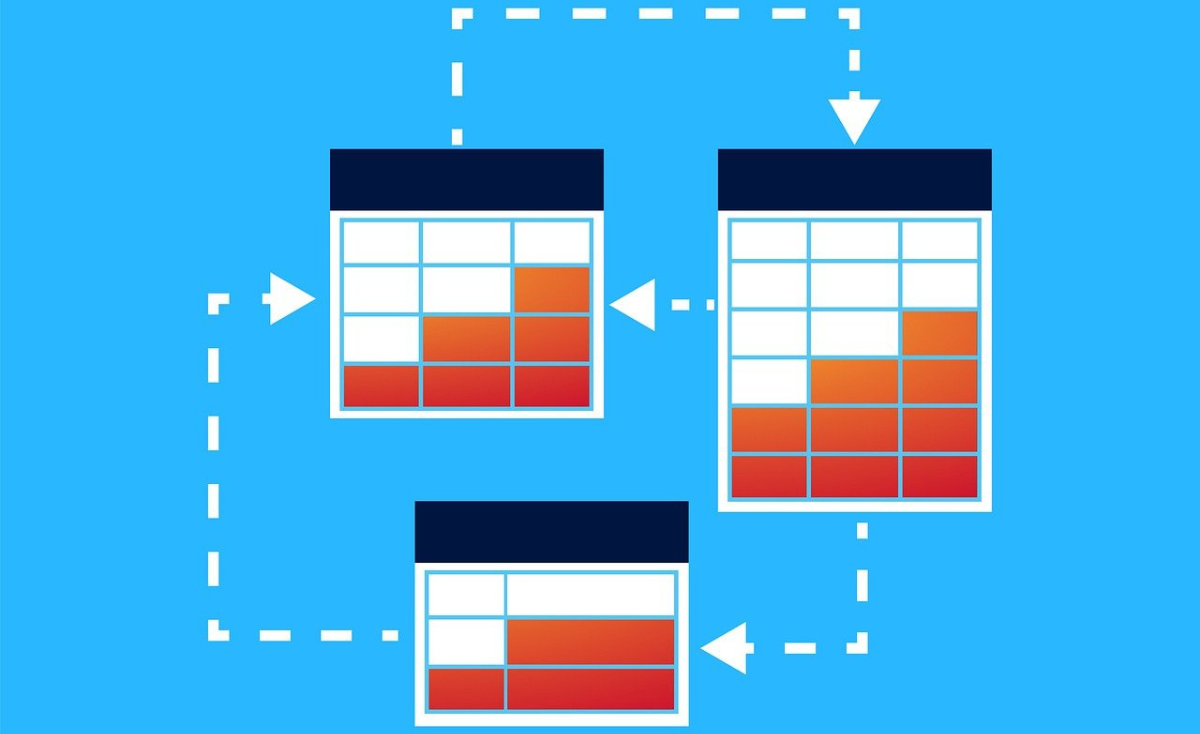

In addition, the participants looked at the workflow cycle and how it affected the choices they made and what they were hoping for.

The conversation now forms the basis of a report, “Addressing operational challenges around launching a private credit strategy”, sponsored by Arcesium.

In it, the figures – from Arcesium, Oaktree Capital Management, Bayview Asset Management, Russell Investments and Macquarie Asset Management – share their views and practical advice on achieving good results.

Below, Ester McEwan, Chief Financial Officer of Funds, Bayview Asset Management, and Keith Brakebill, Senior Portfolio Manager, Investment Division, Russell Investments, give their thoughts.

"It is a necessity to be able to provide those time-weighted returns to investors because

it is what is going to make it comparable across the rest of their portfolio."

Andrew Putwain: I’m curious about challenges in investment performance reporting and what is typical in terms of utilising time-weighted rates of return that are required versus money-weighted rates of return. Also curious about benchmarking for performance reporting?

Keith Brakebill: From an LP perspective, they would love to move towards more time-weighted - sometimes from the GP side and fair enough if they are building a multi-manager or multi-fund program as almost anyone would. This can be a bit more challenging on the GP side.

It is something that we take on a lot because we are usually running the entire pie for investors and pulling these together.

It is a necessity to be able to provide those time-weighted returns to investors because it is what is going to make it comparable across the rest of their portfolio and allow you to integrate from a reporting standpoint into the rest of what they are doing. Oftentimes this is not seen as the problem from the GP perspective on our side but to a degree you can be helpful in solving your clients’ problems at their total pie level when they are reporting up. This is going to be a feather in your cap from a GP standpoint.

Andrew: What do you see as the most common structure for a US residential whole loan fund vehicle and what has been the biggest challenge when launching?

Ester McEwan: We have been doing this for a long time here so when we launch a new one it hasn’t been challenging. For someone who is launching this, especially for the first time with some of our SMAs, it is getting to know the different pieces. You need so many different kinds of connections and service providers when you have residential mortgage loans there are trustees involved so you need diligence and building this out because there are licensing requirements with owning residential whole loans.

There are also mortgage servicers who are the people who collect on behalf of yourself if you have a mortgage yourself. It is also about connecting with them, adjusting data and reviewing the data. It is about deciding how you are going to monitor these loans at the loan level.

"It is about either having the expertise or partnering with someone

who has the expertise to do servicing oversight."

Many of our peers tend to do this at the pool level but we want to ensure that it is granular so we do it loan by loan so we can track the performance.

It is then about either having the expertise or partnering with someone who has the expertise to do servicing oversight, which is something that we do and asset management. It is different from managing a bond as you are potentially working with a servicer on loan modifications and getting into foreclosures so there is expertise that you need internally.

It is about how you own these too as we typically set up trusts, Delaware Statutory Trust is how we own them and again this has a little bit to do with certain licensing.

You can read more of McEwan and Brakebill’s thoughts, and the report in full, here.

Please Sign In or Register to leave a Comment.

SUBSCRIBE

Get the recent popular stories straight into your inbox